For instance if your taxable income per year is 200000 and you make a. Tax Exemption with an Example.

Government of Malaysia V MNMN.

. There are virtually millions of. Only 274 units of new EVs were registered in 2021 from total industry volume TIV of 508911 units. Life insurance and EPF INCLUDING not through salary deduction.

Higher Education Institute that is accredited by related Government authorities. He receives a basic salary of Rs. Article 41 and Article 1211 of the Federal Constitution of Malaysia 1957.

China will extend its exemption of new energy vehicles from purchase taxes to the end of 2023 creating tax cuts worth a total of 100 billion yuan state media Xinhua quoted cabinet. Mr Verma employed in Mumbai is living in a rented accommodation and pays a monthly rent of Rs. At the same time the maximum tax exemption per employee is RM3000year.

15000 PM from. Income tax Malaysia starting from Year of Assessment 2004 tax filed in 2005 income derived from outside Malaysia and received in Malaysia by a resident individual is exempted from tax. 10000 during the fiscal year 2017-18 the assessment year 2018-19.

This full version contains the full text of the Model Tax Convention as it read on 21 November 2017 including the Articles Commentaries non-member economies positions the Recommendation of the OECD Council the historical notes and the. An estimated 50 of Irans GDP was exempt from taxes in FY 2004. As per the revised tax exemption act effective April 1 2017 When you make donations above 500 to Akshaya Patra your donation amount will be eligible for 50 tax exemption under Section 80G of Income Tax Act.

The BEAT provision is effective for base erosion payments paid or accrued in tax years beginning after December 31 2017. Although Malaysia is neither a tax haven nor a low tax jurisdiction for companies which are eligible for the tax incentives the effective tax rates may be significantly below the normal corporate tax rate of 24. Additional exemption of RM8000 disable child age 18 years old and above not married and pursuing diplomas or above qualification in Malaysia bachelor degree or above outside Malaysia in program and in.

100 tax exemption on QCE incurred within 5 years and this is to be used for a statutory income offset of 70 or 70 exemption on income tax for a period of 5 years. Sections 99 103 106 and paragraph 341 Schedule 5 of the Income Tax Act 1967. For instance a manufacturing company with a pioneer status tax incentive pays an effective tax at the rate of 72 as only 30 of its profits are subject to tax.

Overseas Leave Passage on the other hand is slightly different from local leave passage. Budget 2022 offered 100 per cent exemption of import and excise duties as well as zero road tax for CBU EVs up to December 31 2023 and 100 per cent duty exemption for CKD EVs up to December 31 2025. Assuming youre a sales manager who will travel to Australia to attend a trade conference.

30000 with an HRA of Rs. For example if you take up a job while overseas and you only receive the payment for the job when you are back in Malaysia. With Overseas Leave Passage the company will not be entitled to a tax deduction.

Order 92 Rule 4 of the Rules of Court 2012. All educational equipment imported towards these schools is exempted from import duty. For tax years beginning after December 31 2025 the percentage of modified taxable income that is compared against the regular tax liability increases to 125 135 for certain banks and securities dealers and allows all.

This publication is the tenth edition of the full version of the OECD Model Tax Convention on Income and on Capital. The exemption is calculated by reducing the donated amount from your taxable salary. While Budget 2022 had announced.

Taxation in Iran is levied and collected by the Iranian National Tax Administration under the Ministry of Finance and Economic Affairs of the Government of IranIn 2008 about 55 of the governments budget came from oil and natural gas revenues the rest from taxes and fees. Lets understand the process of HRA tax exemption under with an example.

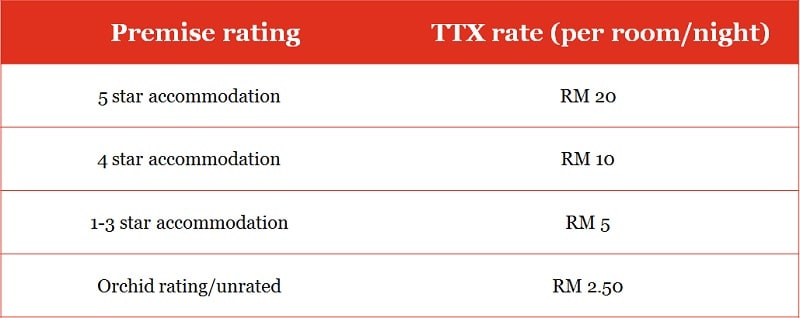

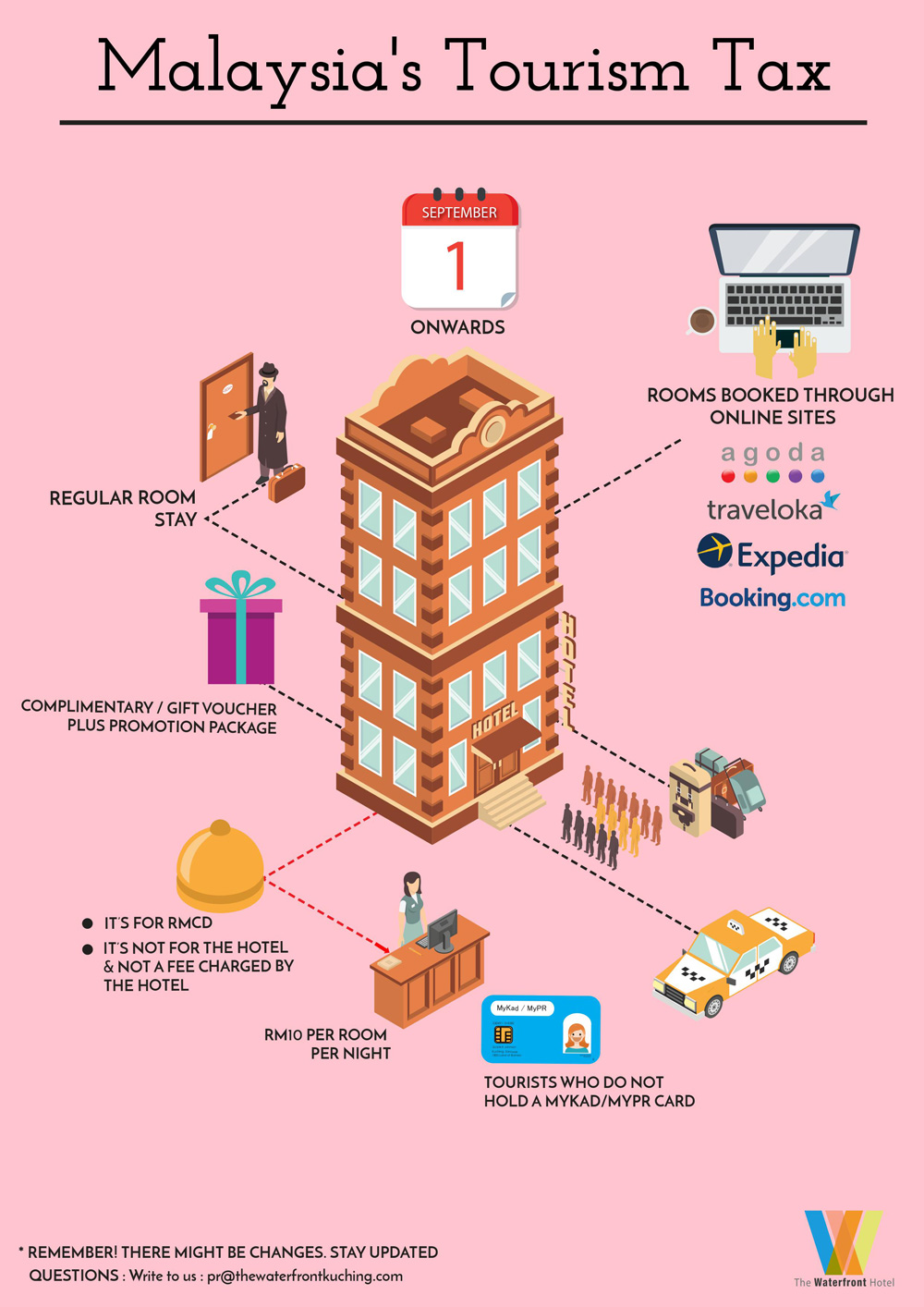

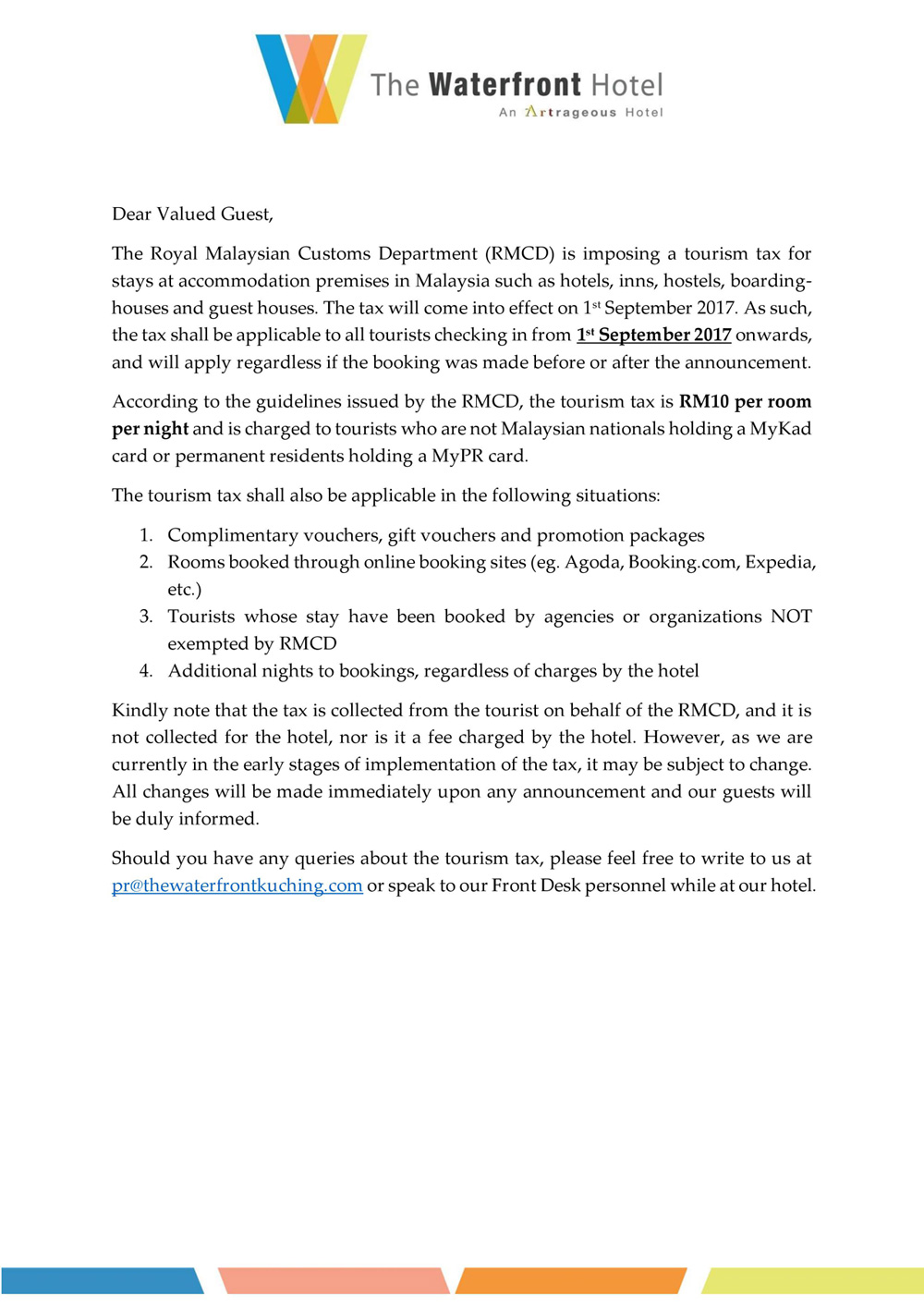

Malaysian Tourism Tax The Waterfront Hotel

Corporate Income Tax In Malaysia Acclime Malaysia

Malaysian Tourism Tax The Waterfront Hotel

Compensation For Loss Of Employment In Malaysia Tax Treatment Tham Consulting Group

What Uk Tax Do I Pay On My Overseas Pension Low Incomes Tax Reform Group

Last Week For Income Tax Benefits The Star

Baojun E100 All Electric Battery Cars Are Seen While They Are Being Charged In The Parking Lot In Front Of A Bao Car Sustainable Transport Green Transportation

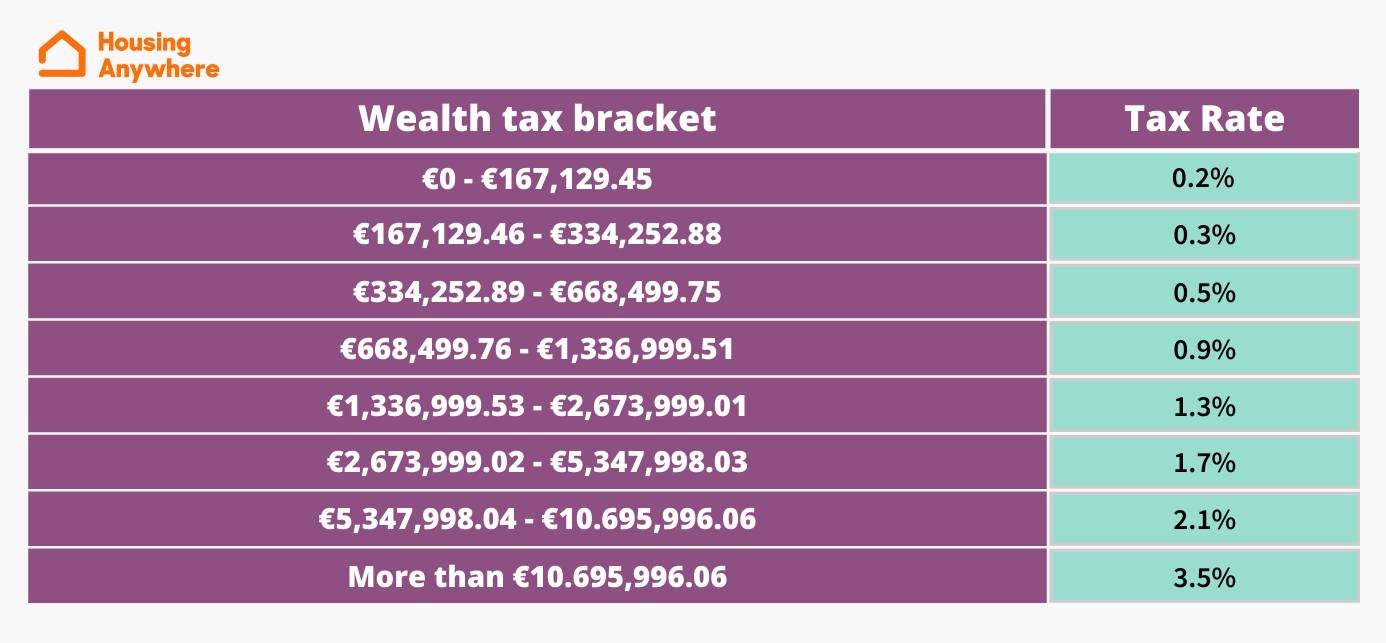

How To Pay Tax In Spain And What Is The Tax Free Allowance

Corporate Income Tax In Malaysia Acclime Malaysia

Pdf Sales Tax Compliance And Its Determinants In Malaysia

Update On Anti Dumping For Some Monosodium Glutamate Msg Food Additives Asian Cuisine Chinese Restaurant

Service Tax Exemption On Eligible Labuan Incorporated Entities

Esos What You Need To Declare When Filing Your Income Tax

Tax Relief For Year Of Assessment 2018 Plctaxconsultants